-

Adani Group’s Rs 12,500 crore bid for KSK Mahanadi Power surpasses competitors, sparking revised offers.

-

Lenders anticipate rare full recovery, potentially retrieving 92% of the asset’s Rs 29,330 crore debt.

-

Adani’s bid reactivates interest, with six initial bidders revising offers, intensifying competition.

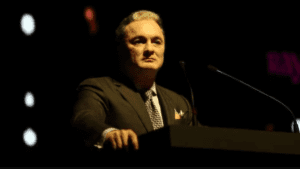

Gautam Adani’s massive Rs 12,500 crore bid for KSK Mahanadi Power has reignited interest among competitors. The Adani Group’s offer, 62% higher than the next bidder, prompted six rivals to revise their bids.

KSK Mahanadi Power, a distressed 1,800 MW plant in Chhattisgarh, owes Rs 29,330 crore. Adani’s bid could help lenders recover around 92% of the debt, a rare achievement under India’s Insolvency and Bankruptcy Code (IBC).

The Committee of Creditors’ Challenge Mechanism stimulated competition, aligning with IBC’s goal of maximizing value. Adani’s recent acquisitions, including Lanco Amarkantak and Coastal Energen, demonstrate its growing presence in India’s power sector.

Industry experts see this intensified corporate interest as a landmark moment for India’s insolvency framework, highlighting the IBC’s effectiveness in restructuring and value

maximization.