-

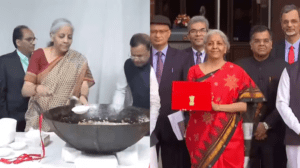

Fintechs are seeking regulatory clarity and certainty in the upcoming budget.

-

They are requesting lower TDS rates, subsidies for R&D, and uniform KYC rules.

-

The industry is also seeking enhanced subsidy payments for UPI payments.

Fintechs in India are hoping for a growth-friendly environment in the upcoming Union Budget 2024-2025. They are seeking regulatory clarity and certainty, as many startups were forced to change their business models due to the Reserve Bank of India’s guidelines. Fintechs operate in regulatory grey zones, and the lack of specific guidelines has been detrimental to several startups.

The industry is also requesting lower Tax Deduction at Source (TDS) rates, subsidies for Research and Development (R&D) employee costs, and uniform KYC (know your customer) rules for all financial services. Additionally, payment companies are seeking enhanced subsidy payments for UPI payments, as they incur losses due to the absence of merchant discount rates (MDR).

The government’s support is crucial for fintechs, as they play a significant role in promoting financial inclusion and digital payments. The industry is expecting the budget to provide incentives and subsidies to promote R&D activities, create employment opportunities, and extend the reach of digital payments across tier 3 towns and beyond.