- Anglo American Plc declines BHP Group’s $39 billion takeover offer, stating it undervalues the company.

- Anglo’s chairman mentions the proposal’s structure as unattractive, with high uncertainty and execution risks.

- BHP’s bid aimed to merge the companies, becoming one of the largest transactions in the mining industry.

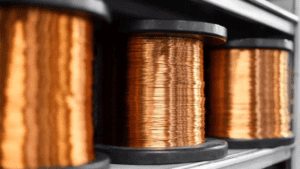

In a recent development, Anglo American Plc turned down BHP Group’s proposed $39 billion takeover bid, deeming it undervalued and citing concerns over its structure. Anglo’s chairman, Stuart Chambers, expressed dissatisfaction, highlighting the substantial uncertainty and execution risks largely borne by Anglo, its shareholders, and stakeholders. BHP’s bid, amounting to £31 billion, sought to merge two global mining giants, enhancing BHP’s portfolio with copper mines, crucial for the global economy’s decarbonization efforts.

BHP’s proposal involved offering 0.7097 BHP shares for each Anglo share and included shares in two South African units to be spun off for Anglo shareholders. Despite the offer valuing each Anglo share at £25.08, Anglo’s shares surged by 13% in early London trading, reaching £24.89. This move, rejecting the takeover, halted what could have been one of the mining industry’s largest transactions. The combined entity would have positioned BHP as the world’s largest copper producer, significantly impacting the global mining landscape and catering to the rising demand for copper amid the shift towards renewable energy and electric vehicles.